The evolving world of payments is an important topic in the world of business and finance. The new payment systems have evolved over the years, making buying and selling goods online more accessible and efficient. The rise of digital payments has made it possible for people to transact with each other across the globe. With new payment technologies, we can buy and sell anything online or in person the way we would in our neighborhood.

Moreover, with the recent evolvement of payment, everything is different now, but it’s also the same. Thanks to the Internet, it has become easier to keep track of the world around us and how we fit into it. But this means more opportunities for people and businesses to connect and make transactions without meeting face-to-face.

Evolution of Payment System

In today’s world, most of us rely on sitting in front of the computer and ordering things online. So, it’s not surprising that the payment process has also evolved. In the early 2000s, online payment was very nascent, with only e-commerce giant Amazon using it. But today, we see many other companies using it with mobile wallets and other apps, making it convenient for us to pay through our phones.

Before, people used coins, paper money, and checks to make payments. Nowadays, with the current evolution in the payment system, we use credit cards and debit cards. Credit & debit cards are a more convenient way of paying for goods or services. They are also more convenient than carrying cash around with you all the time.

Another evolution in the payment system has come into the picture after the introduction of blockchain technology. This technology is changing the payments landscape by making it easier to conduct transactions with cryptocurrencies and by reducing the friction in international trade. With blockchain, international payments can be cleared in a matter of hours, compared to the several days it takes with traditional payment methods.

As blockchain technology continues to evolve & develop fiat payment systems will likely become obsolete in the near future. Payment processing companies, like Mastercard and Visa, have been exploring web3 opportunities for a few years now. Seeing growing popularity, both have partnered with cryptocurrency exchanges and wallets. In Q4 2021, payments made with Visa cards connected to cryptocurrency amounted to $2.5 billion, compared to the $47.6 billion in total payments processed by Visa. In April 2022, Mastercard took another step by announcing the launch of the world’s first crypto-backed credit card.

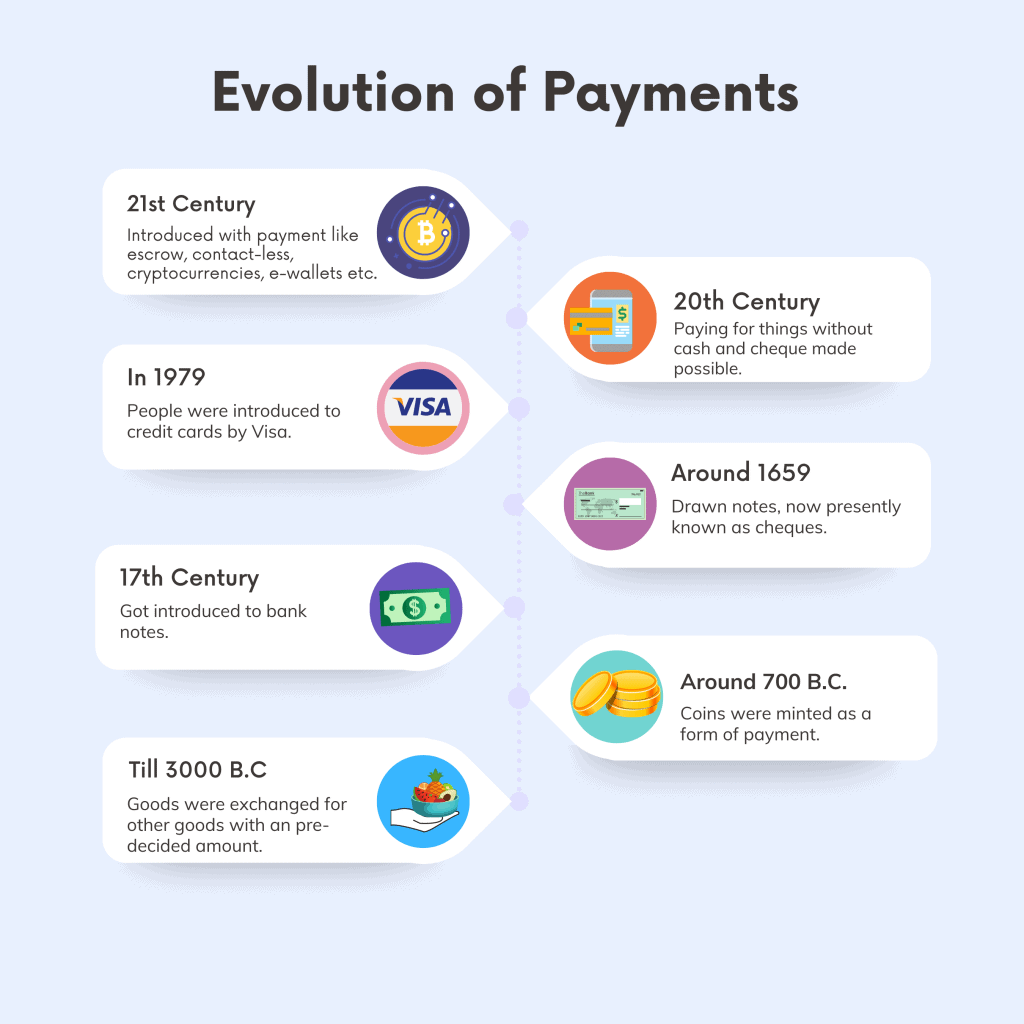

Now let’s shed some light on the evolution of payment systems, from early barter to modern-day payment to today’s lighting network and beyond.

Early Barter to Modern-day Payment

After bartering, a method by which people converted their goods into “money-objects,” in the 7th century BC, the Greeks developed the coin, a form of payment that has survived to the present day. There was then a small leap in history to when paper money was created in China in the 7th century AC. However, its European introduction had to wait until the 10th century. Europeans began to utilize this form of payment thanks to trade with Asia. With time, banknotes have evolved to incorporate security features that make them more difficult to counterfeit.

Cards have been a big revolution in the world of payment methods. They’re light and simple for people to use, which makes them essential for our daily lives. However, they’ve evolved since 1914, when the first model appeared. Western Union created a specific card for its most select customers that year; This allowed them to access a line of credit free of charge.

Moreover, the birth of the Diner Club card happened as a form of payment for dining at any restaurant in 1949 when a man named Frank X. McNamara forgot his wallet at home and couldn’t pay for his food. This has allowed him to make the payment for the service at the end of each month.

Another ground breaking-technology came in the form of contactless payment. This payment method is mainly based on NFC (Near Field Communication) and was developed in 2002 by two tech giants, Sony and Phillips. They wanted a protocol that would allow any two terminals to exchange information and then process it close to each other.

The NFC technology didn’t initially have any applications for mobile payments. Google was the first company to launch a digital wallet in 2011. This digitized the subscriber’s cards. Then, in 2014, Apple launched Apple Pay. This was the first mobile digital wallet that could be used to make payments in physical shops and online.

Today’s Fast Payment Network, Web3, and Beyond

Online payment service provider like Visa, Mastercard, PayPal, Square, and Swift Authorize.net has transformed how we make our online transactions. Not to mention how the Lighting Network (LN) of Bitcoin, Blockchain, Web3, and Web5 took the transaction process to a new height in the last few years. But such fast evolution in online payment has caused rising fraud cases. As a result, reviewing and educating users to be more aware of their transactions is more inevitable than ever.

Today, Bitcoin’s Lightning Network is a game-changer in cryptocurrency’s evolution. Adding a second layer to Bitcoin’s network allows off-chain transactions to be processed much faster with reduced cost.

On the other hand, the Web3 payment ecosystem has enabled one-click payment from customers to merchants. PayBolt, a major project building the next-generation payments gateway for Web3, is working to change the way we think about commerce. This ecosystem includes a mobile wallet for iOS and Android, a merchant payment portal, point-of-sale terminals, & eCommerce plugins. It aims to bridge the customers who want to spend crypto and the businesses that accept it as a form of payment.

Web5, a merger of Web2.0 and Web3 to build authorized Decentralized Apps (DApps) and protocols, wants to let every user control their data and restore them without centralized arbitration. This decentralized web browser and platform that is aiming to end web monopolies. It’s less prone to hacking and surveillance than the internet you use now.

Now, with the dramatic increase in popularity of all these evolving online payment systems/networks in recent years, In 2019, the global online payment market was valued at $3,286.52 billion and is projected to reach $17,643.35 billion by 2027, with a compound annual growth rate (CAGR) of 23.7%. This growth is driven by several factors, including the increasing use of mobile devices for commerce, the growing preference for cashless transactions, and the continued expansion of e-commerce.

Evolution in Payment System: The Trending Digital Payment Methods

Digitalization in payment methods has experienced a massive jump over the past decade. All everyone expects is to have a secured, reliable, fast, and convenient payment system that makes the life of its user easier. It has somewhat achieved its goal with further developments in line in the coming years. Some of the latest evolvements in trends over the past few years include the following digital ways of payment:

Contactless Payment

With contactless, payment apps make money transfers, bill payments, and ticket purchases – all at the tap of a finger. The beauty is that you can do it all without carrying cash or cards. Just create an account, store your payment details and make quick and easy payments whenever and wherever you need to.

But you must remember there are some costs associated with contactless payments. You’ll need to buy card terminals, for example, that have near-field communication technology. There’s no fee to accept Apple Pay or Google Pay, but rates and fees apply to any credit card transactions.

Biometric Authenticated Transaction

Today, almost all smart devices have biometric authentication facilities. It has many features that are beneficial to customers. This is why authenticating transaction through biometrics are a popular trend when making payments nowadays. They are specifically convenient because customers do not have to remember a password or carry a key.

This payment method is also in trend among shoppers as it is more secure because they cannot be lost or stolen like a password or key. Moreover, biometric authentication is more difficult to spoof than other forms, making it more secure. Overall, devices with biometric authentication are more convenient and secure for customers, making them an excellent choice for anyone looking for a new device.

Smart Speakers

Smart speakers are one of the biggest pieces of technology in the market today. Users can play music, set reminders, or even control a smart home through them. However, some of the biggest tech companies are using these speakers for something else: to pay for goods and services.

Today, consumers can pay for their products and services using smart speakers like Amazon Echo and Google Home. These smart speakers are capable of making instant payments through voice-activated payments.

This digital payment trend has a projected growth from 18.4 in 2017 to 77.9 million users by 2022. Amazon Echo was the first to introduce a smart speaker to enable this revolutionary voice-activated payment.

Social Media Payment

You’ve probably heard that social media is a powerful tool, especially when advertising your business. But did you know that social media is also a powerful tool for making payments? In fact, in 2018, Avionos conducted a study that showed that 55% had purchased through social media at some point. Social media is an excellent resource for anyone looking to expand their business.

All three social media sites, Facebook, Instagram, and Pinterest, offer business accounts that allow brands to sell straight to the consumer. These digital payment transactions are conducted on the site, and there’s only a small fee.

Mobile Point of Sales (mPos)

Mobile Point of Sales or mPos is a new digital payment method that is becoming increasingly popular. It allows businesses to accept payments through a mobile device such as a smartphone or tablet, making it very convenient for companies and customers. There are many reasons why mPos is trending as one of the best digital payment methods.

One of the main reasons is that it is straightforward to set up and use. All you need is a compatible mobile device and an internet connection. This makes it ideal for small businesses that may not have the resources to invest in more traditional point-of-sale systems. Additionally, mPos is very flexible and can be used in various settings, such as retail stores, restaurants, and events. Another reason mPos is so popular is that it offers several advantages over other digital payment methods.

Cross-border Payments

Cross-border payments have become increasingly commonplace as the world has become more connected. These financial transactions occur when the payer and recipient are based in separate countries.

These payments are made for various reasons, such as trade, tourism, etc. In most cases, it is also being made to send money to family or friends living in another country. Or, they may be paying for goods or services that have been sourced from overseas.

The evolution in cross boarder payment is astonishing. The earlier mode of sending money abroad via post has gradually evolved into SWIFT, third-party apps, and now Cryptographic mechanisms such as XRP. The influence of crypto and blockchain on cross-border payments is only growing; The recent partnership between an oracle blockchain, Chainlink, and the largest banking network, SWIFT, is an indication of that.

Impact On the Payment Cost Due to Blockchain Technology

The cost of digital payment transactions has been reduced drastically by the introduction of blockchain technology. These digital transactions take place on a public ledger that records data transfers. And there’s only a small fee involved in these transactions, making it easier for people to get money in and out of their accounts without paying extra fees.

Examples of Some Digital Payments Methods After The Evolution of Payment Systems

Digital payments refer to any transaction completed online without cash or a card. Some examples include

- PayPal: A faster, safer way to send money, make an online payment, receive money or set up a merchant account easily.

- Stripe: With Stripe, you can accept payments from anywhere in the world, and they offer a suite of tools to help you manage your business.

- Blockchain: A secure, efficient, and reliable digital payment system that uses cryptography to secure transactions.

- Bitcoin: A digital payment system that allows users to send and receive payments without needing a central bank or other financial institution.

- Crypto: A new digital payment system that allows users to send and receive payments in cryptocurrency

- Encryption: With end-to-end encryption, your personal and financial information is protected from start to finish with this new form of digital payment.

- Privacy Coins: A new way to keep your transactions private, safe, and secure. With Privacy Coins, you can rest assured that your information is protected.

Fee Comparison of Some Popular Payment Service Providers

The fee comparison of some of the popular payment service providers goes something like this:

| Payment Gateway Companies | Transaction/Processing Fees |

| PayPal/Pro | $2.9% + 30¢ |

| Authorize.net | $2.9% + 30¢ |

| Square | 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards & Virtual Terminal has a 3.5% + 15¢ fee. |

| Swift | $25 to $65 (Depends on Bank) for a wire transfer |

| Visa | 1.29% + $0.05 to 3.29% + $0.10 |

| Mastercard | 1.39% + $0.05 to 3.29% |

| Bitcoin | The fee varies from 0.5% to 4.5%, depending mainly on the increasing demand for processing transactions through the Bitcoin network |

| Solana | 1 SOL~ $32, charges $0.00025 per exchange |

| Ethereum | The average Transaction Fee is at a current level of 0.4297, down from 0.5888. It varies day to day. |

The Future of Payment Systems: Changes and Evolvement to Expect

What are some significant changes we can expect to see in the future? As mobile payment services such as Apple Pay, Google Pay, and Samsung Pay become more popular and gain momentum, there will likely be a shift from cash to electronic payments. This includes credit cards ($1 trillion market cap), Mastercard ($7.6 trillion), and American Express ($3.5 trillion).

Introducing new technologies in the payment industry has been one of the most significant changes in recent years. The future of payments is not just about the evolution of credit cards and debit cards but also about how we pay for things, how we verify our identities to make payments, and how we get paid.

As artificial intelligence becomes a more prevalent part of our lives, it also plays a more prominent role in digital and online payments. With its ability to learn and process data quickly, AI is well-suited to secure the future of digital transactions. It is doing all that by predicting credit card behavior, reducing false card declines, fraud detection & large-scale document data extraction.

The future of the payment system looks pretty solid with the introduction of blockchain technology as it is s distributed database that will allow for transparent, secure, and tamper-proof asset transfers making the payments process faster and more secure.

After all, the future of payments is all about convenience. We will probably witness the shift from cashless to contactless transactions in the next 20 years. This new technology will only revolutionalize from here on. Moreover, it will be easier for people to pay for goods with their phones or wearables than with traditional payment methods like cash or credit cards.

Mortuza is a certified Digital Marketer with a Master’s degree in International Economic Relations (Spec. International Business), driven by a deep passion for the intersection of technology, innovation, and investment. An entrepreneurial professional and crypto native, he is immersed in the web3 space, exploring blockchain, NFTs, and the metaverse. Beyond web3, Mortuza dedicates significant time to researching emerging trends in AI, cutting-edge technologies, and disruptive business models, seeking to understand and capitalize on the future of innovation.